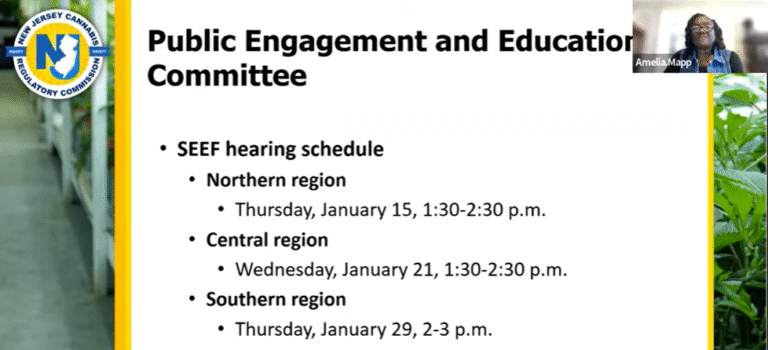

The NJ Cannabis Regulatory Commission (NJ-CRC) held a special meeting to announce that they will hold Social Equity Excise Fee (SEEF) tax town halls in January.

Table of Contents

Commissioner Amelia Mapp explained the plan. She noted that feedback from the hearings will be compiled into a report to the Governor and Legislature.

“We want to hear your thoughts, ideas, and suggestions,” she said.

The SEEF hearings will be held on Thursday, January 15th at 1:30 for North Jersey, Wednesday, January 21st at 1:30 for Central Jersey, and Thursday, Jan 29th at 2 for South Jersey.

“We look forward to seeing all the engagement from members of the public…,” NJCRC Chair Dianna Houenou noted.

The SEEF tax was the only thing they discussed at the brief meeting.

At their last meeting, the NJ-CRC pushed discussion of raising the SEEF tax this year.

SEEF Tax Issues

The legislature designed the SEEF tax to increase when the price of cannabis decreased below a certain amount. It is a wholesale tax on cannabis, so consumers aren’t supposed to pay it. However, many industry advocates have claimed the cost would be imposed on consumers.

Businesses often pass on costs like tariffs to consumers.

The NJ-CRC slightly raised the SEEF tax last year to $2.50 per ounce of cannabis from $1.24 per ounce of cannabis. They did so after many industry advocates and entrepreneurs argued the planned larger increase would greatly hurt them.

Social Justice Versus Business

Adult-use cannabis legalization was supposed to bring in a lot of tax revenue to the State of New Jersey. How that money was to be spent is a hot topic. It divides social justice advocates like the American Civil Liberties Union (ACLU) of NJ from the more business-minded groups like the NJ Cannabis Trade Association (NJCTA).

It is especially difficult to devote more money to social justice programs for entrepreneurs who are not making the money they expected. Some might use social justice rhetoric to argue the SEEF tax would harm small, minority owned businesses.

But some of them might be against it even if they were making the money they wanted.

At the same time, the price of cannabis has been decreasing steadily. It was at a ridiculous height due to an alleged cartel engaged in price fixing and red tape imposed by the State. It’s unfortunate that moderates demanded rules that increase the cost of doing business.

The NJ-CRC is supposed to have the power to raise the SEEF tax. This is according to the NJ legalization law, the Cannabis Regulation Enforcement and Marijuana Modernization Act (CREAMMA).

However, a proposal to raise the SEEF to pay for programs was in Governor Phil Murphy’s Fiscal Year 2026 budget. The legislature ultimately excluded it from the budget they passed before the Fiscal Year began on July 1st at the 11th hour. A large budget passing at the 11th hour is customary for Jersey.